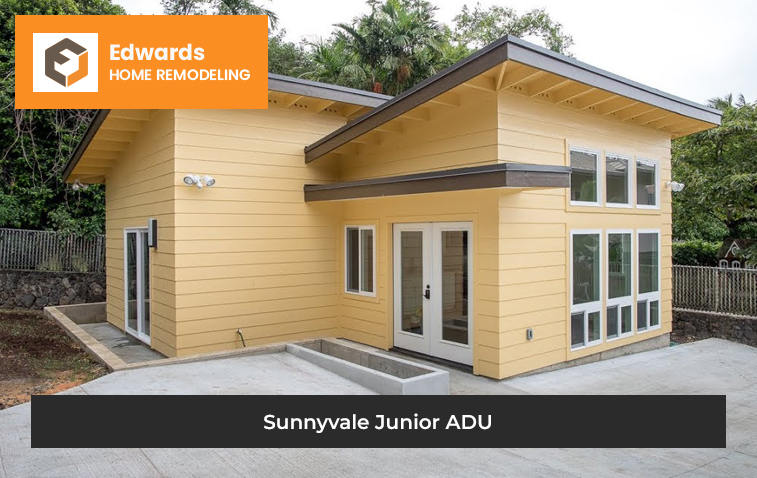

Are you looking to add more space and value to your home? A Sunnyvale junior ADU could be the answer! This versatile addition has become increasingly popular in recent years and offers homeowners a range of benefits.

Various financing options are available, including conventional loans, VA loans, and private loans. Research and compare to find the best deal for your situation. Look into local programs, such as the Sunnyvale Junior ADU program, for additional benefits and financing opportunities. Understand terms and negotiate with lenders to secure the right financing for your ADU project.

In this blog post, we’ll discuss how to finance your Junior ADU and share some helpful tips for making the most of this unique living space. Whether you’re looking to generate rental income or create a comfortable home for your loved ones, a junior ADU in Sunnyvale is a wise investment that can enhance your property and lifestyle. Keep reading to learn more!

Financing a Sunnyvale junior ADU is a strategic move with numerous advantages. A junior ADU is a self-contained living space with a bathroom, kitchen, and separate entrance, making it an attractive feature for potential buyers and increasing your property’s value. Additionally, an ADU provides a steady stream of rental income.

This can be particularly lucrative in a high-demand housing market like Sunnyvale. A junior ADU provides an affordable housing solution for family members, such as aging parents or adult children, fostering familial bonding while ensuring privacy and independence.

Start by evaluating your financial health— lenders will examine your credit score, employment history, and debt-to-income ratio. It’s essential to ensure these are in good standing. Next, gather all necessary documents, such as proof of income, asset documentation, and a detailed plan of your ADU project.

Lenders often favor borrowers who show preparedness and organization. Researching various lending options, such as home equity, personal, or construction loans, can also increase your chances of approval.

Remember, different lenders offer different terms and interest rates, so shopping around is crucial. Finally, be ready to make a down payment. Although the amount may vary, having a substantial down payment can significantly increase your chances of being approved. Partnering with Edwards Home Remodeling gives support and expertise in financing your Sunnyvale Junior ADU project.

These loans are often used by homeowners seeking to build or renovate a junior ADU. What sets conventional loans apart from other forms of financing is their strict adherence to specific guidelines set by Fannie Mae and Freddie Mac. These guidelines often require a high credit score and a 20% down payment. However, with proper financial planning, a conventional loan can help Sunnyvale residents achieve their dreams of building the perfect junior ADU.

FHA loans, or Federal Housing Administration loans, are government-insured mortgages that offer borrowers a variety of benefits. The program has played a critical role in increasing access to homeownership, especially in areas like Sunnyvale, where the need for affordable housing is exceptionally high. Whether you’re a first-time homebuyer or looking to purchase a Sunnyvale junior ADU, FHA loans offer several unique advantages, including lower down payment requirements, competitive interest rates, and flexible credit guidelines.

The U.S. Department of Veterans Affairs backs these loans and offers a range of benefits to eligible applicants, including low or no down payments and competitive interest rates. While VA loans were initially designed to assist veterans in purchasing a primary residence, they can also be used to buy, repair, or construct ADUs. This financing provides financial security and flexibility for those interested in investing in a junior ADU property.

These loans, sponsored by the U.S. Department of Agriculture, offer competitive interest rates with the option of no down payment. But what many may need to realize is that USDA loans aren’t just restricted to traditional homes. They can also be utilized for unique housing options such as an ADU (accessory dwelling unit) or even a junior ADU, which has become increasingly popular in areas such as Sunnyvale.

A hard money loan is obtained through a private lender rather than a traditional bank or credit union. These loans are often sought out by real estate investors looking for short-term property funding. The benefits include fast processing time, flexible terms, and financing for unique or non-conforming properties. If you are interested in investing in the Sunnyvale Junior ADU market, a hard money loan can provide the necessary capital to secure a property and generate income quickly.

These loans are not guaranteed by the government and are offered by private lenders such as banks, credit unions, and online lenders. Personal loans are often easier to obtain than traditional ones because their requirements are typically looser.

They come in various forms, such as personal, short-term, and bridge loans, each with features and qualifications.

Choosing the right financing option is essential when building an accessory dwelling unit, or ADU, on your property. One popular option is the ADU program, which provides financing for Sunnyvale, California, homeowners who want to construct a smaller dwelling unit on their property.

With this program, homeowners can receive financing for up to 100% of the construction costs, making it an attractive option for those without significant upfront capital. However, exploring all financing options available is essential to ensure you are making the best decision for your unique situation.

If you need help with the right financing option, contact us. We can help you find the financing that suits your needs and provide the resources to make your ADU dream a reality. Contact us today for more info!

To secure the best financing deal for your ADU project, thoroughly research and compare different loan options. You must also understand the terms, such as interest rates, repayment schedules, and potential penalties. For example, a lower interest rate can significantly decrease the total amount you’ll pay over the life of the loan.

Improving your credit score can qualify you for better terms. Remember to negotiate with different lenders, as some may be willing to offer better rates to compete for your business. Lastly, consider the total cost of the loan, not just the monthly payment. Lower monthly payments could result in a more extended repayment period, ultimately costing you more in the long run. By taking these steps, you can secure a financing deal that aligns with your financial goals and project needs.

Financing your Junior ADU project doesn’t have to be a daunting task. With the correct information and resources, you can choose the best financing option that suits your unique situation. Whether you opt for a conventional loan, FHA loan, VA loan, USDA loan, hard money loan, or private loan, understanding the terms and comparing different options can help you secure the best deal. Remember to explore local programs, such as the Sunnyvale Junior ADU program, which may offer unique benefits and financing opportunities. With proper planning and the right financing, you can turn your ADU dream into a reality.